Citi secured credit cards offer many benefits. Some of them include no annual fee, flexible payment due dates, and 0% APR. Others offer no liability for fraudulent purchase. You can learn more about these cards and their potential benefits for your financial future. A credit card that doesn’t help build credit is not something anyone wants.

There is no annual fee

Citi Secured Mastercard is an international no-frills credit card that can easily be used in millions across the globe. It is ideal for people with little credit, poor credit, or no credit. Cardholders can focus on building credit and making timely payments with the no-annual fee option.

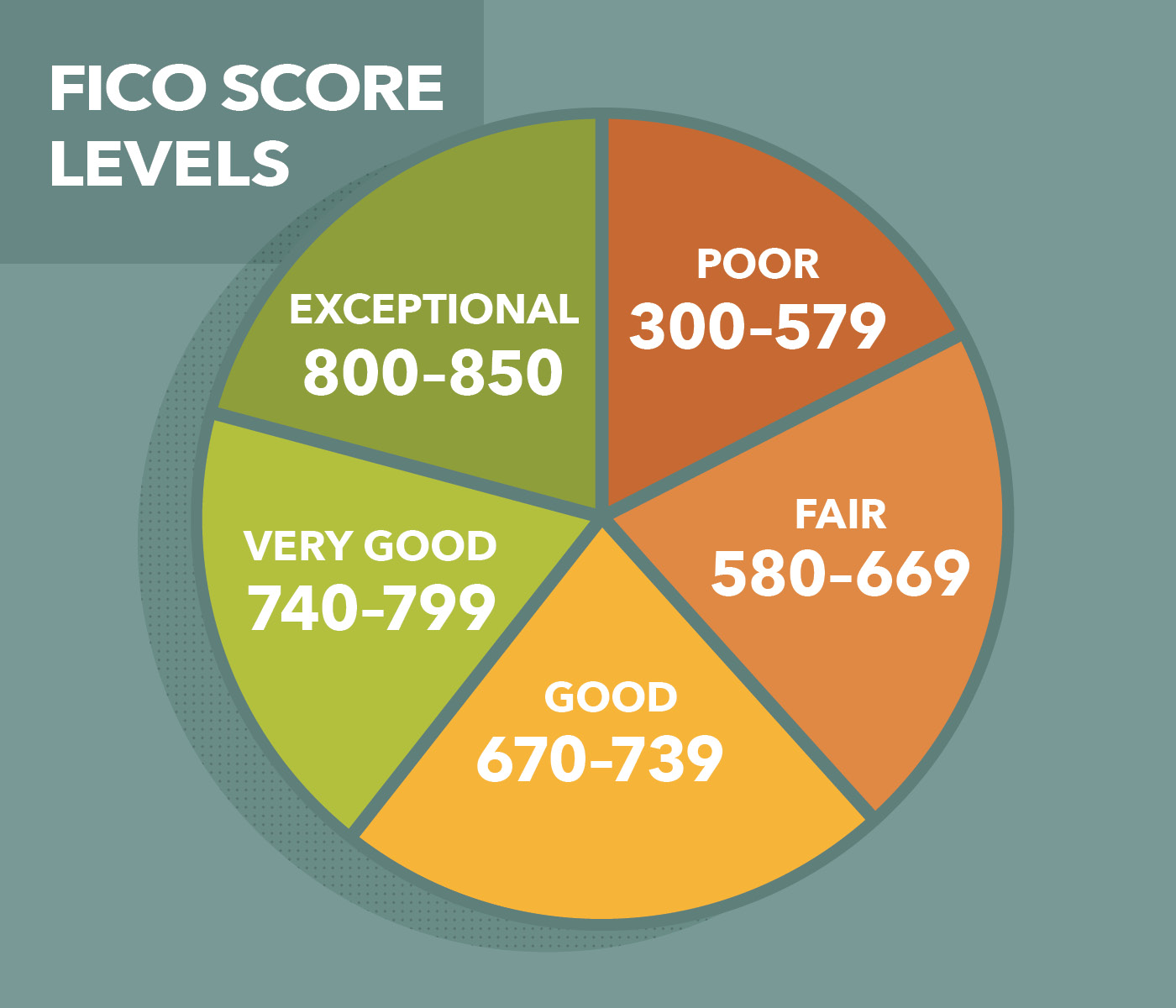

Citi Secured Mastercard does not have an annual fee. It is a great tool to begin building credit history. It reports to all three major credit bureaus each month, and allows you to access your FICO score online for free. The card is accepted worldwide and does not have an annual charge.

Flexible payment due dates

Citi credit cards offer flexible payment terms and can be helpful if you are having difficulty paying your monthly bills. These cards give you a lot of flexibility in how you pay, and they also help you build your credit history. You can also set up Auto Pay to automatically pay your bill, so that you never miss a payment.

The card reports your spending to the major credit bureaus. It allows you to improve your credit score, and can help you build good credit. However, if you are not careful you could damage your credit history by failing to pay a bill or making large purchases. Don't use your card to max it out, this will severely damage your credit score.

For fraudulent purchases, there is no liability

It's a smart idea to have a creditcard with zero liability for fraudulent transactions if you are worried about being charged with fraud. The details of each issuer's zero liability policy can vary. They are available on the issuer’s website. If you suspect your account may have been misused or abused, you can call them directly. In addition, many cards provide 24-hour monitoring and have parameters for determining if a charge is fraudulent. You may also have the option to receive texts or secure messages asking you to confirm purchases. You may be held responsible if you cannot verify a charge within sixty-days.

A credit card that has zero liability for fraudulent purchases also offers other benefits, such as the flexibility of payment due dates or 24/7 customer service. Citi credit cards also offer zero liability for illegal purchases. The company also offers free identity theft assistance with the Citi Identity Theft Solutions, which can help you if your identity is stolen. Citicards also regularly monitor your account for fraud and notify you if there is any suspicious activity.

0% APR

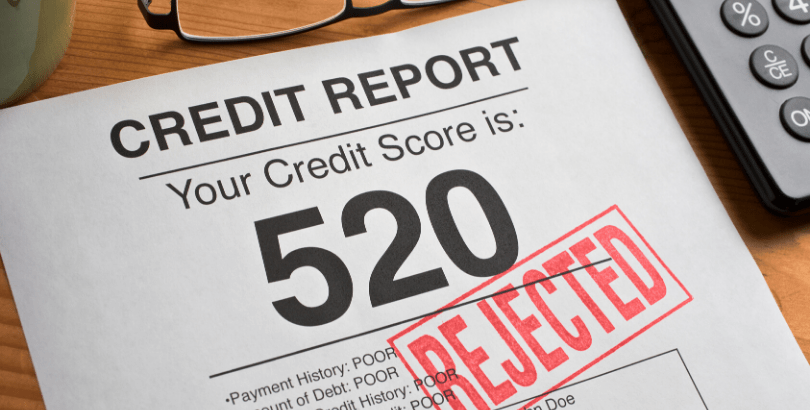

A Citi secured card with 0% APR Citi credit can be a great option for anyone who has had credit issues in the past. You'll need to deposit $200-$2,500. It is refundable if it isn't used. It also offers a number of other benefits such as an intuitive mobile app and flexible payments terms. Although a secured card doesn't earn rewards, it is a great option for those with a poor credit history or limited credit history.

Citi will examine your credit history, and report on account activity to the credit bureaus. This can help with getting better interest rates. It takes approximately four weeks for a decision to be made on your application online. You will need to wait seven to 10 business days until you receive your decision.

No foreign transaction fee

The Citi Secured Mastercard is an excellent credit building card with no annual fee. All you have to do to get the card is deposit a security deposit of at least $200. The card allows you to have a credit line of up $2,500. This card has no fees other than balance transfer fees up to 3% and a foreign transaction fee of 3%.

The Citi Secured Mastercard has no annual fee and standard APR rates. It includes a contactless payment card chip to speed up transactions. It offers exclusive offers on travel, dining, and entertainment. Even though it's not the best credit card with no annual fee, it offers many benefits. Although the cash back program is not very generous, it can still add up to a significant amount each year. The card has one real drawback: the foreign transaction fees.