There are many things you can do to improve your credit score. These are some of the things you can do to improve your credit score.

Timely payment of monthly installments

Paying your monthly bills on time is one way to increase your credit score. Lenders use a formula to determine your credit score, and the lower the balance, the higher your score will be. Lenders also consider how much you owe relative your credit limit.

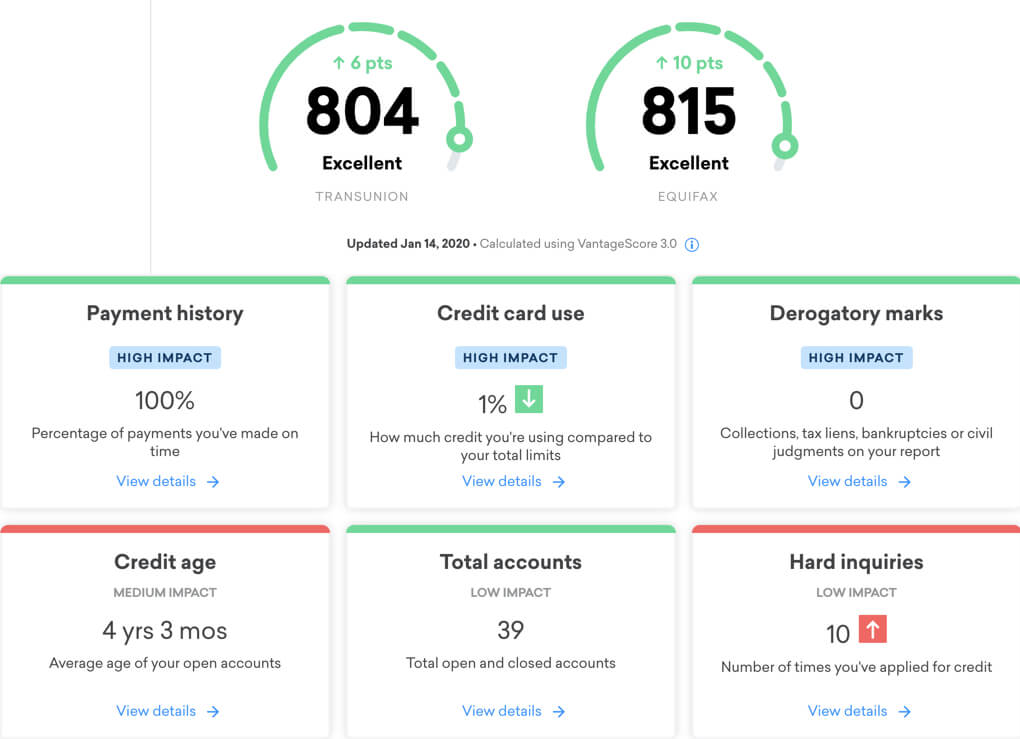

As payment history accounts for 35 percent of your total FICO score, it is crucial that you make your payments on time. You can lose anywhere from 20 to 100 credit points by missing payments. Avoid this from happening by making your monthly payments on-time.

Reduce your debt

You can improve your credit score by making timely monthly payments and paying down all debt. Making steps to improve credit scores can lead to lower loan rates as well as fewer fees. A good credit score could save you thousands of money over the loan term.

Reduce your debt to 30% to increase your credit score. This is also known as the credit utilization ratio. When evaluating your loan application, lenders will consider your credit utilization ratio. Ideally, you should be using less than 10% of your available credit.

New credit cards: Limit your spending

Limiting spending on a new credit card can improve your credit score. Credit utilization is weighed three times as heavily than new credit inquiries. This means that if you use your new credit card to make large purchases, the benefits of it will be reduced. Make minimum payments and clear delinquent accounts. Instead, you should use it. This is the most efficient way to improve your credit score of 200 points.

By paying your card twice a monthly, you can increase your credit score. This will lower your credit card balance and reduce your spending. This can help you improve your score quickly. This is especially important if you are applying for a loan. Lenders will examine your credit score and not the balance of your account when you apply. So make sure to pay your balance every month.

Your credit report is inaccurate?

There are several ways to raise your credit score. The first is to identify and dispute errors on your credit report. This can be done online and by calling the credit bureaus. The dispute process does not cost you anything. If credit bureaus find errors in your report, they place you into a lower risk category.

You can also write a letter to the credit reporting agency if you find an error on your report. Your claim must contain the details and proof of the error. The credit reporting company should respond within 30 working days. Sometimes it may take longer for credit reports to reflect the changes. You can reach out to the company if the dispute isn't resolved within the specified time. You should not exaggerate any claims.

Limit the amount of times you request credit scores

It's important to limit the number of times you request your credit score. This is because credit card issuers might perform a hard pull which could lower your score. Your score will recover over time, however. However, in some cases you might be denied for a higher credit limit.