If you're applying for your first credit card, you may want to consider the advantages and disadvantages of different types. There are several factors that you should consider, such as the annual fee, credit limit and co-signer option. The best option for you will depend on your own individual circumstances and goals.

Annual fees as low as possible

A no-fee credit credit card can be a great way for you to build your credit history. No-fee cards are especially helpful for people who have no credit history or have recently established a small credit score. They can help you establish a credit profile that will be able to allow you to apply for a better car or mortgage.

Many starter credit card programs don't have annual fees, and they are easy to apply for. Depending on the terms and conditions of the card, these cards can offer better rewards and perks. Some no-fee cards will waive the annual fee for the first year, but some have a higher interest rate than others.

Before applying for your first no-fee credit card, you must check your credit report to determine if you qualify for this type of card. Your report will include information on your credit history and any student loans you may have. This information is used by financial institutions to calculate your credit score.

Credit limit low

It's common for your first creditcard application to be denied if you have a low credit limit. Many factors can influence this. Your age, income and credit score all determine the credit limit you will receive. The typical credit limit of the first credit card you apply to is between $500 and $1,000. You might be eligible for a higher limit if you have excellent credit.

It is important to understand that your credit limit will change over time. You should not exceed your credit limit as it can lead to negative consequences. You have a few options to increase your credit limit on your first credit card.

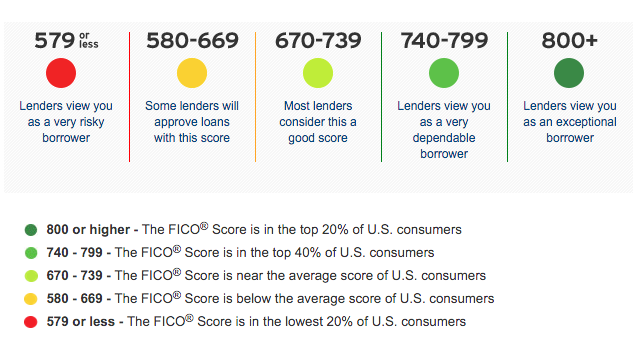

Before applying for credit cards, check your credit score. A high credit score is a sign that the issuers have trust in you, and they will increase your credit limit. Also, ensure that you pay your bills on time. If you are unable or unwilling to pay your bills on-time, you can apply again for a card with a greater limit.

Option to co-signer

Although it may seem tempting to ask a friend or family member for a joint credit card, co-signing with an account in a joint name can lead to serious problems for both of you. One, joint accounts have a low credit limit. Some banks also do not report activity. Also, if the cardholder fails to make payments, the co-signer is responsible for the debt and can see the cardholder's statement. The co-signer can be penalized for late payments.

Applying for your first credit cards should be done with someone you trust. It can be difficult to get approved for new credit cards if your credit is not good. However, if you have someone responsible with good credit, you will have a better chance of getting approved.