If you don't yet have a credit history, it can be difficult to establish one. Without a credit history, you may find it difficult to obtain loans, credit cards, apartments, and other products that require a credit history. Start building your credit by getting your free credit report. You can then determine the best actions to take. Start by getting a secured card, or becoming an authorized user of another card.

It is important to pay on time

There are many tips to help build credit, including paying on time. First, make sure you pay the minimum due on time. This will not only reduce your total amount but it will also increase your credit utilization ratio. This can be a significant component of credit score. You can do this by setting up automatic payments for your bills. You will have no extra money worries as your bank account will automatically debit the date of the payment.

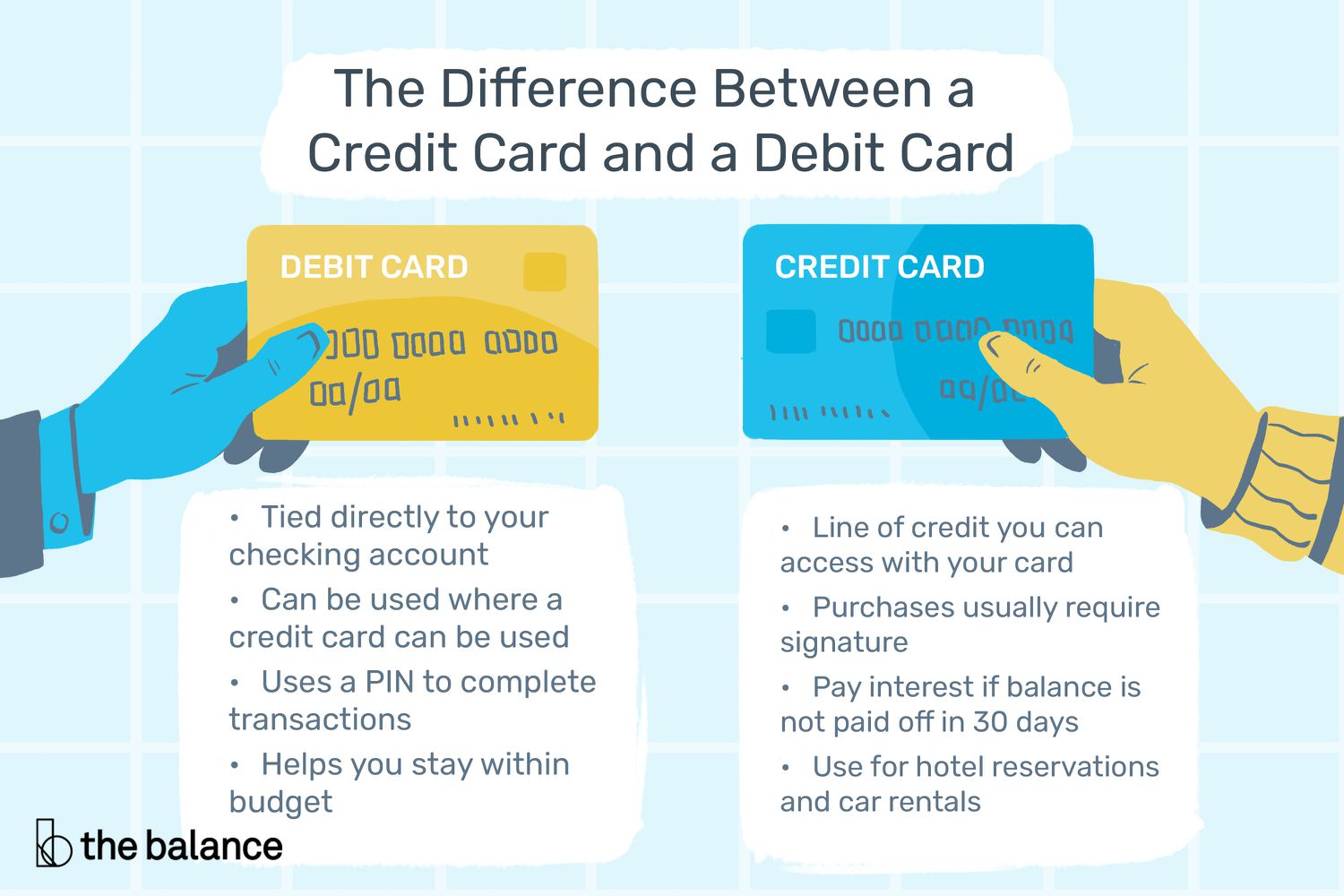

Credit cards are open to all

Credit building is a complex process that requires you to take into account many things. First, make sure your accounts remain active. The lower your credit limit, the better. You must also limit your use of credit cards. Also, pay off the balance before the statement period expires (21 to 25 calendar days prior to the bill due date). You may feel tempted to pay off your balance instantly, but this will damage your credit score. It will increase your utilization rate and decrease the average age you have your accounts.

Repaying charges

Some people believe that paying off charges will improve credit scores. However, this is not true. While charge-offs are negative marks on your credit history, they will slowly fade over time. To improve your credit score, you can use the funds you have to pay down any open accounts, settle charges-offs, and get rid of collections. Follow these steps to improve your credit rating and financial standing.

Repayment of collection accounts

The payoff of collection accounts can have many benefits for building credit. While you may not see instant results, these actions will have a lasting impact on your credit score and report. You will need to work hard and take time to improve your credit score. Paying off collection accounts is a good first step. There are many ways you can do this. First, decide which type of account to delete from your credit report.

Get a store creditcard

A store credit credit card is an option for young consumers looking to build their credit. They work exactly like regular credit card, but have a credit limit. This limit is the maximum amount you can spend on the card. While it isn't ideal, if you pay off the balance in full before the due date, you can avoid paying interest. Also, most store cards give you rewards for spending, usually in the form of store credit.

Installment loans

An installment loan could be the right option for you if you have bad credit or are looking to improve your credit score. These loans allow for you to borrow substantial amounts of money and have it repaid over a fixed period. You can apply online for these loans, or offline. The terms of installment loans are different for each company.

Monitoring your credit reports

Monitorizing your credit report is a good idea for many reasons. Monitoring your credit report can help you spot fraud and errors. Credit card companies often allow you to see your score each day. Monitoring your credit report is crucial for building a positive credit score, whether you are looking for work or just applying for credit. To protect yourself against identity theft, you might also consider a credit monitoring company. You'll get a notification each time your credit report is changed.