While credit cards are an excellent way to build credit, they also come with many risks. It is also important that you consider whether or not you have the ability to repay your loan. Many credit cards offer 0% interest rates which is a great deal for many.

A credit card is a great way to build your credit score.

Getting a credit card can help you establish a solid credit history and improve your credit score. Avoid excessive spending with your card as it can affect your credit score. Find a card that meets your needs and then only use it to pay for necessities.

There are many types of credit cards. The easiest to get are the secured cards. These cards report monthly to the three major credit bureaus and often have low annual fees. Some of them even offer rewards such as cash back.

It can also have long-term consequences

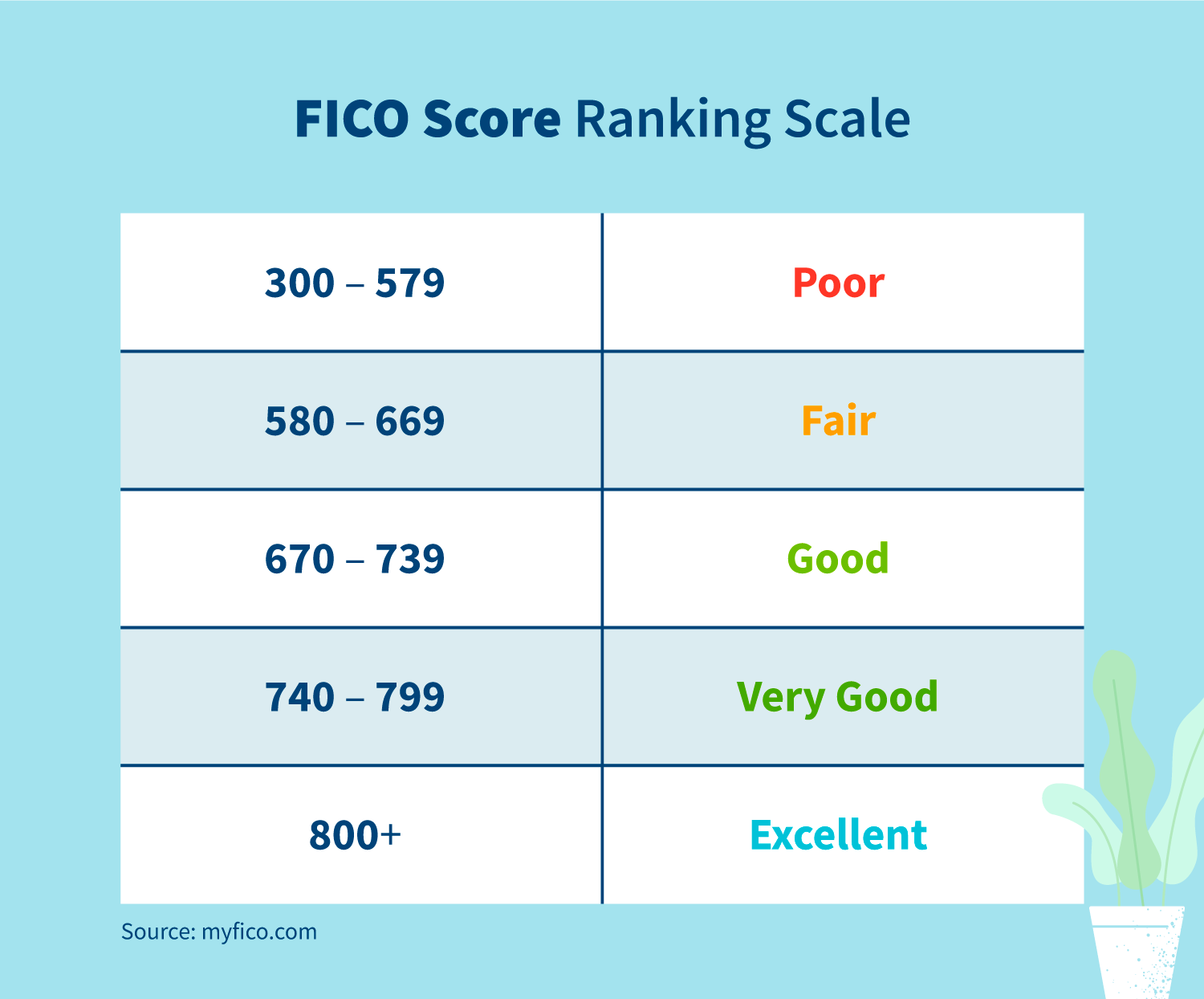

Using your credit card responsibly is a great way to improve your financial life, but you also need to be aware of its risks. To begin with, overextending your credit card can hurt your credit score. Lenders use your credit score to determine the terms of any loans you apply for. Higher credit scores mean better terms and lower interest rates. This can also result in lower insurance rates.

It could be dangerous

While credit cards can be beneficial, they can be dangerous if used improperly. They can improve your credit score and can also help you avoid financial disasters like debt and irreversible financial stress. Credit cards provide rewards that can help you travel and pay other expenses. Credit cards offer rewards that can be used for travel and accommodation.

It can be a boon.

Credit cards are a good way to build credit. However, it is important that you are responsible with it. It can affect your credit score and cause you to default on the payment. This will make it difficult for you to obtain a loan at a favorable interest rate. By paying your balance in full and staying on top of it, you can avoid this. You can also create an automatic payment reminder that will make it easier for you to remember.

Credit cards can be a powerful financial tool. But if you don’t use them properly, they can be very detrimental. A good credit record can lead to lower rates on insurance and large loans. Even better credit can get you a lower mortgage interest rate. This could help you save thousands.