The frequency of updates will depend on the time that your creditors report to credit bureaus. In most cases, it is approximately once per month. However, it may vary depending on the number of accounts. Credit Karma will automatically send you an email whenever a new report is made available.

VantageScore 3.0(r).

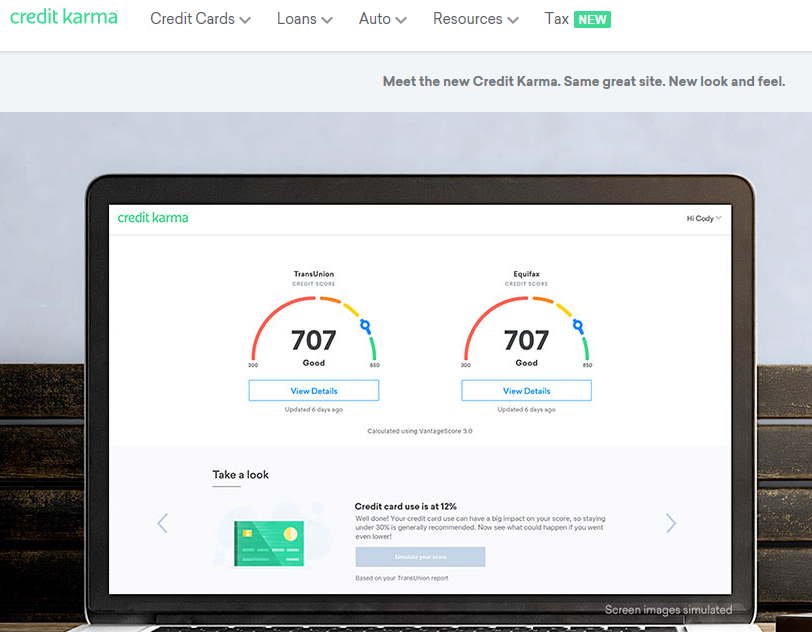

If you're a member of Credit Karma, you might have noticed an update in your score. VantageScore 3.0, a reliable predictor of bank scores, is one of many credit scoring models. Moreover, you can check the updates every day or weekly, without having to sign in or create an account.

The new model uses trended data and could lower the impact of judgments and tax liens on your credit score. VantageScore scores don't take into account the same information that credit scores from other companies. There are many factors that can affect your VantageScore score.

FICO 8

If you are using Credit Karma to monitor your credit score, you can see your score on the website once a week. However, if you don't log in regularly, you may not see the update until 30 days after it occurred. It can take up two weeks for the information from your creditors to reach the credit bureaus.

Credit score updates are triggered when your creditors report to the credit bureaus. Credit bureaus receive information from most lenders every month. This includes late payments, debt paid off, and new debt. Your score can change in a shorter or longer time depending on how many accounts it has. Logging in can activate a refresh of your dashboard. You will receive an email notification when your score has changed.

Experian 8

Credit Karma offers a way to keep track of your finances by updating your credit score. It is free to join and you will be able to see your score and report within seven days. Credit Karma does not update its reports as frequently as the credit bureaus. Because lenders often take 30 to report customer activity to credit bureaus, your score may not reflect the most recent activity for several weeks.

Credit Karma checks your credit scores from TransUnion and Equifax every day. It will also show you your VantageScore. Because your credit score reflects data from all three major credit reporting agencies, it is vital to understand how it is calculated. It is important to note that mistakes can hurt your score, so if you believe there is inaccurate information on your credit report, you should dispute it. Credit Karma provides a direct dispute option for consumers to dispute incorrect information on credit reports.

Equifax

It can be difficult to know exactly how often Credit Karma updates credit scores, but it is typically every seven days. Credit Karma updates you credit score every seven days. However, the major credit agencies may not update your credit score as often. Because lenders take between 30 and two weeks in order to report new activity on credit reports, this can be frustrating. You should therefore check your credit score often to ensure it is accurate.

Credit Karma uses VantageScore, which is a scoring system that differs from TransUnion's and FICO. Credit Karma's score does not necessarily represent what you need information for major loans. Credit Karma still works well to monitor your credit.

TransUnion 9

Credit Karma usually updates your credit score once per week. If you are interested in seeing any changes, however, you need to check your credit report frequently. Credit Karma receives TransUnion data updates once every seven days. This means that if you do not log in to your account at least once a week, you may not see the updated score for up to 30 days. Your lending institution may take up to two weeks to update your credit report.

The major credit agencies update credit scores whenever creditors report new data. The frequency of reporting and the number you have of accounts will impact the frequency of updates. If you make late payments on credit cards, it can take between four and six weeks for your score. You might need to wait seven days for your credit reports to reflect the fact that you made a recent payment on your mortgage.