There are many factors that affect the calculation of your credit score. These include the age of the debt and hard inquiries. Other factors are late payments, and the amount of your debt. The credit bureaus receive reports from lenders on a monthly basis. There are a few things you can do to speed up your update. Below are three methods to speed up the update process. The speed at which your score gets updated can vary between lenders.

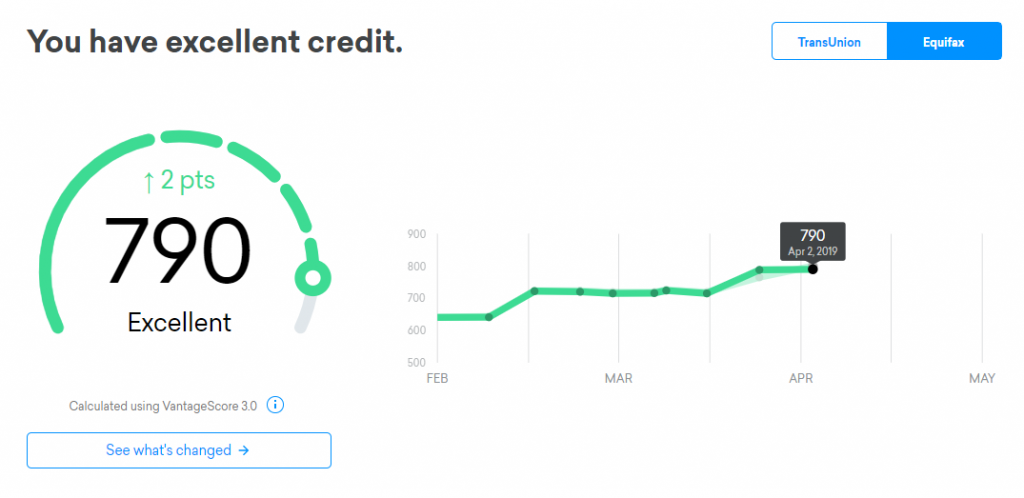

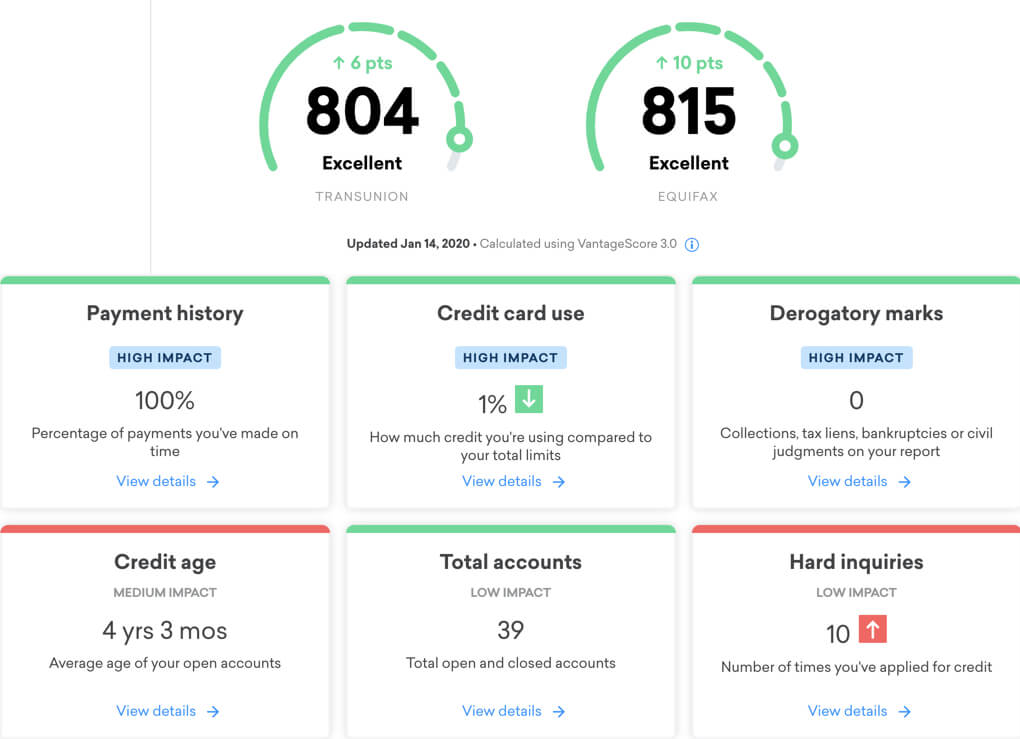

Credit scores are affected by difficult inquiries

While every hard inquiry will lower your credit score, not all of them are created equal. Different types of loan inquiries have different impacts on your credit score. Multiple inquiries on the loan can count as one, although some credit agencies allow a 14-day to 45-day grace before reporting the new inquiry. A recent inquiry may appear as a single inquiry if you didn't make the payment within a year.

Late payments impact your credit score

There are many factors that can affect credit scores. Your credit score will be affected by late payments. Your credit score will decline if your payment is late 30 days. If you pay the entire account in full within 30 day, this can be avoided. A delinquent account will be reported to credit bureaus as a delinquent account and can negatively affect your credit score.

Credit scores are also affected by age.

Also important is how old your debt is. Credit scorers prefer to spread debt over many years. Therefore, a fortyyear-old who has one credit card will likely have several more accounts open than an 18 year-old who has one. While an adult of this age might have only one credit card, a 40-year-old will have multiple accounts, including a mortgage, car loan, and credit cards.

Credit bureaus are contacted by lenders once a month

Credit card issuers aren't required to report to the credit bureaus, but they typically do. Credit bureaus use this information to determine how creditworthy a customer is, and lenders can benefit from this information. Many lenders report monthly to credit bureaus. Here are the most popular times creditors report to the credit bureaus. These dates can vary from lender to lender, so make sure you check with your lender for exact dates.

Other factors affect your credit score

There are many different factors that affect your credit score, including how frequently you pay your bills and the length of time you have been using credit. These factors can help build and protect your credit. Credit scoring companies use data from your credit reports to calculate your score. While they won't divulge their exact formulae, they will let you know what it is. A lower score could be caused by incorrect information or late payments.