If you have ever filed for bankruptcy, it is possible that you are wondering what will happen with your credit. There are options to rebuild your credit, even though you can't open new credit cards right away. No matter if you're looking to open a new credit card or save your home, bankruptcy can help you rebuild your credit.

Rebuilding your credit score after bankruptcy

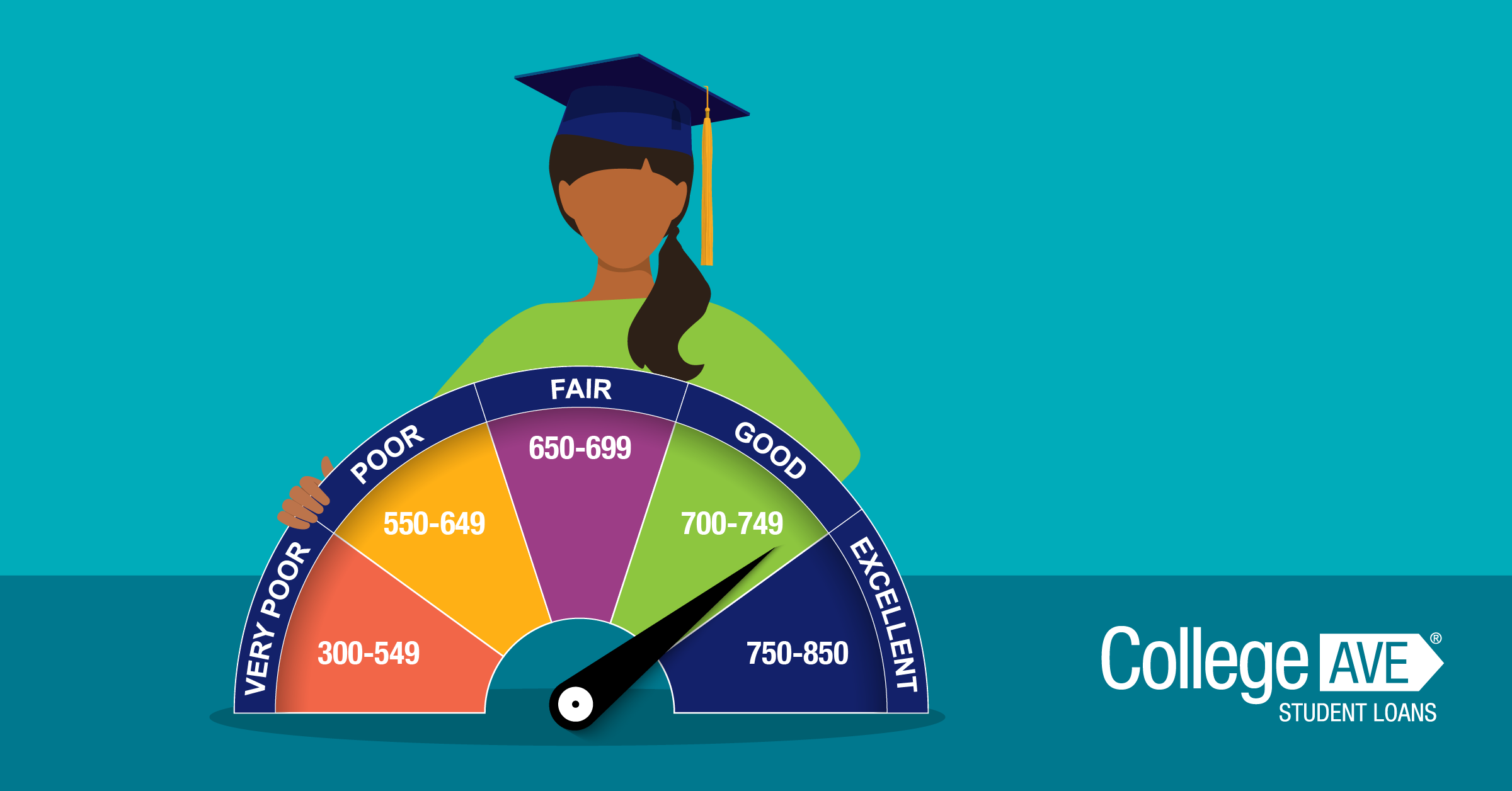

If you follow the correct steps, bankruptcy filings will greatly improve your credit score. Your first step is to make your monthly payment on time. This is critical as your payment history contributes 35 percent to your FICO score. Positive financial habits are also important to improve your score. You shouldn't charge every expense on your credit card. Instead, you should choose one bill to be able to pay each month in full. Once you feel comfortable with the process, you can apply for credit accounts.

FICO scores are affected by your credit card debt. If you have a high balance, you should reduce usage. You should also start building an emergency savings account to avoid debt in the future.

After bankruptcy, how to get a new credit line

Before you apply for a new credit card after bankruptcy, you need to be sure that you have cleared your debt. Bankruptcy can have a negative impact on your credit score, and it will take anywhere from six months to five years to get your debt discharged. Chapter 7 bankruptcy and chapter 13 bankruptcy can be filed, which will eliminate most of your debt. Chapter 13 is also known as a wage earner plan and requires that you make monthly payments based upon your income.

After paying off all your debts you can rebuild your credit score. This is important if you are ever going to be able to get a mortgage loan or car loan. Credit card options are also limited by bankruptcy. It is crucial to understand the terms of each card so you don't get credit problems.

Saving your home after bankruptcy

It is possible to save your house by refinancing your mortgage after bankruptcy. Before you make a big decision, it is important to be aware of all the options and potential risks. First, you should know that you will likely have a difficult time getting a mortgage after bankruptcy. In addition, you must be prepared to pay for a large amount of home maintenance, including landscaping, pest control, and snow removal. Although this can be quite costly, it is essential to plan for the future.

In addition, if you are facing foreclosure, you should file for Chapter 13 bankruptcy. You can file for Chapter 13 to stop collection activities against you and work out a payment plan.