A credit loan builder can help you improve your credit score, make it easier for you to get approved for loans like a mortgage or credit cards with favorable interest rates. But, before you apply for a credit building loan, it is important to know some things. First, people must avoid past credit problems like bounced checks, which could negatively affect their credit scores. You should also avoid late payments. They will lead to interest fees and lower credit scores.

Credit-building loans that are self-credit building are more suitable for you

Self-credit building loans allow the borrower to establish credit without having to do a credit check. They choose a term that corresponds to the amount of funds they want to borrow and make monthly payments until they reach the amount they want. The money is released when the term ends. This process may take up to two week. The majority of institutions won't allow borrowers to borrow more than one builder loan simultaneously.

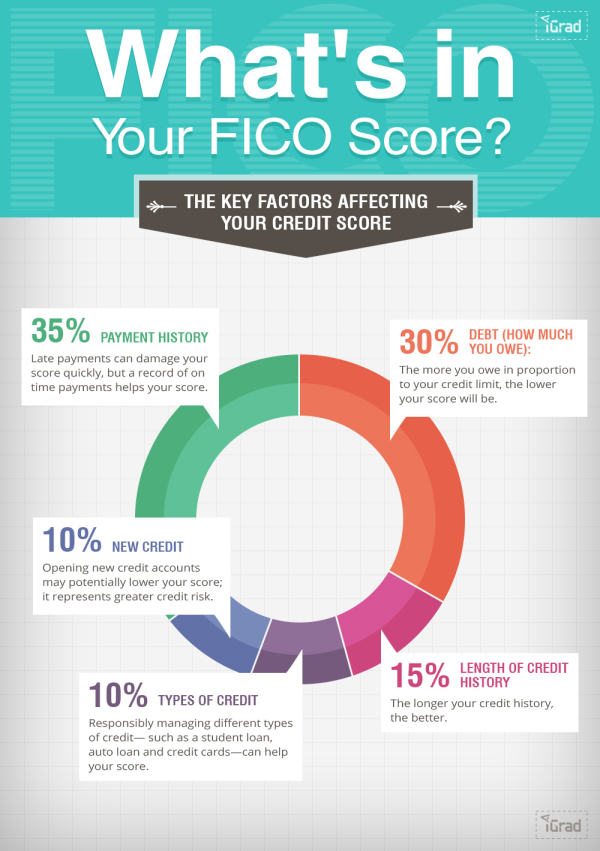

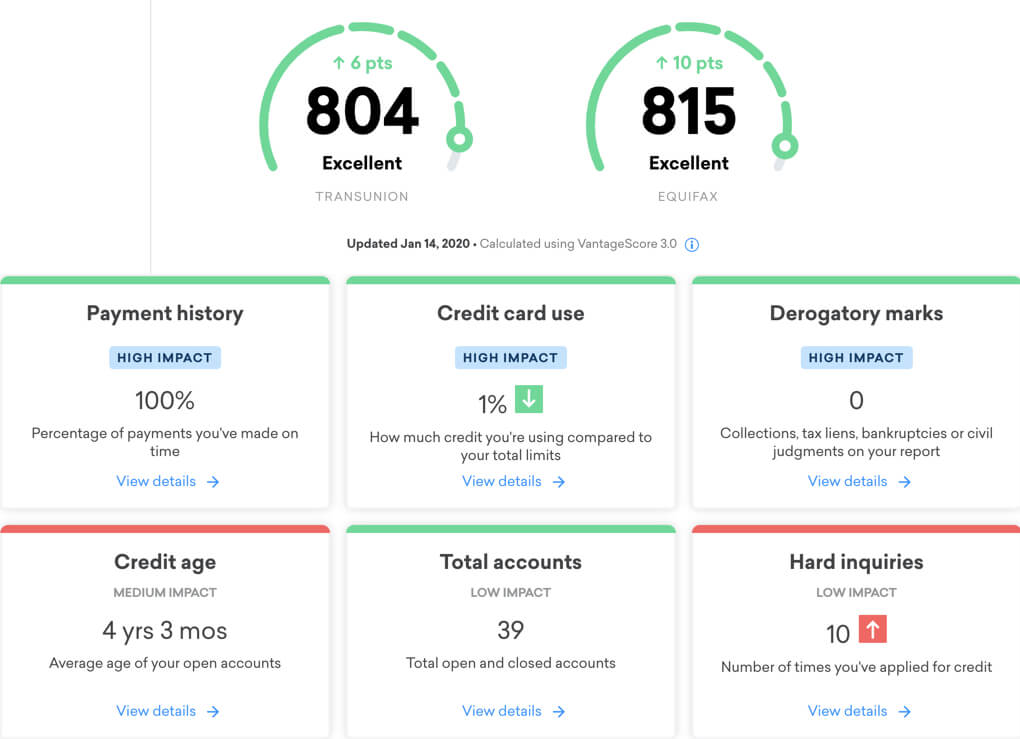

A self-credit builder loan can be very beneficial for those with bad credit or no credit. Since payment history makes up three-fifths of your FICO credit score, it is essential that you make payments on time to build a positive credit history. Self-credit building loans can be affordable, quick to obtain and don’t require credit union qualifications. Self-credit builders loans can be used to improve credit scores for as little as $25 per year.

They will require that you pay the loan in full

A credit loan builder allows you to build credit slowly over time. This loan usually requires you to pay monthly installments. After the loan is paid in full, the lender will transfer the money to your bank account. Credit scores will improve if you keep up with your payments.

The amount borrowed will be deposited to your bank account. However, the money cannot be accessed until you have repaid the loan. The financial institution, credit union, online lender, or other lender holds the money. It can be saved or placed in a CD account. The initial application fee and administration fee may be required. Once you have established satisfactory repayment records, you will have access to your money at any moment.

They are easy to qualify for

A credit loan builder can be a type of loan that helps to build credit. This type of loan has two goals: to improve your credit score and increase the length of your credit history. Petal1 could be one example of credit builder loans. Petal1 accepts applications based on a combination of your banking history and credit score.

Credit loan builder usually involves a small loan, typically for only a few hundred or several thousand dollars. The money borrowed is placed into a savings account and the borrower pays off the loan every month. These payments will be reported to credit bureaus by the lender.

They have low interest rates

For people who want to build credit, a credit lender is a good option. These loans are more accessible to people with bad credit than traditional personal loans and have lower interest rates. These types of loans are offered by many credit unions and banks. If you are already a member of a credit union, you can either ask about these types of loans or search for them online.

Remember that the credit history of the borrower is an important factor in determining a borrower's FICO credit score. Paying on time will increase a borrower’s score. But late payments can have a negative impact. It is essential to ensure that your monthly payments are affordable. To avoid missing a payment you can set auto-pay through your primary account or set up phone reminders that remind you to pay.