Credit score is a numerical representation that shows your credit standing. It's used by lenders as a way to evaluate your ability and risk to repay a loan. A high credit score typically means that you are less likely to default on a loan. The interest rate that you can qualify for will also depend on how creditworthy you are. Your credit score may also impact whether you are approved to get a mortgage, a card, or an automobile loan.

There are many options to improve your credit score. One strategy to improve your credit score is to pay off all debts as quickly as you can. You can also increase your credit limit and close any unutilized credit accounts. Opening a credit account can be another way to improve your credit.

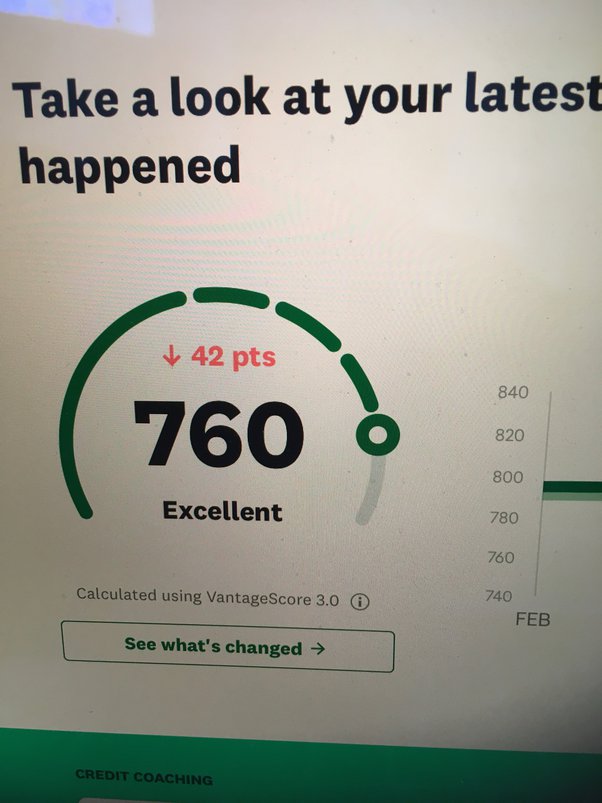

Credit scores are a three-digit number that summarizes your financial history. Credit bureaus generally calculate them. They consider your payment history, the total amount owed and other factors. Your score can be calculated by automated underwriting systems. A low credit score usually means you are high-risk borrower. A low credit score can also mean you will be more likely to get a lower interest rate.

The credit score is something that many people don't understand. However, it can have a big impact on your credit. Several financial institutions, including banks and insurance companies, use the FICO scoring system to evaluate applicants. This simple calculation uses a number of factors to determine creditworthiness.

Your payment history is the most important factor in credit scores. Late payments will not give you a significant boost in credit score. Paying off your debts can make a significant difference to your score.

Also, your credit history's length can have a significant impact. People with a long credit history are less likely to be deemed risky. Lenders view young adults with no track record as a risk.

When calculating your credit score, other factors are taken into account, such as the type of credit that you have, the amount of your current and past balances, credit utilization, and number of accounts. The average credit score is between 850 to 300 depending on where you live. A high credit score will help you get approved and save you money on your home mortgage.

Although the credit score is not the most comprehensive metric, it is still a very important one to understand. It is not necessary that you have perfect credit. However, it is a good idea to keep your expenses low. That way, you will have a better chance of securing the best rates.

Lastly, the credit score can be measured by the number of credit inquiries that you make in a given time period. The rule of thumb is that ten percent of your credit score comes from a recent credit check.