You can use a debit to build credit, but there are some drawbacks as well. Discover the advantages and disadvantages of using a debit card to build your credit. Also, learn how it can impact credit scores. Using a debit card to build credit is an important part of a healthy financial life. Although you won't notice a significant impact on your credit score with a debit card, it is worth looking into.

Use a debit-card to build credit

If you are struggling to establish credit, a debit credit card is a great choice. A debit card does not charge interest if you do not pay the full amount. This means that you can spend and not worry about your credit score. A debit card is also easier to keep to a budget.

A debit card has the greatest benefit: it doesn't affect your credit history. This is especially true for those who are trying to quickly build credit. A fully-equipped and equipped debit card will help you attain the financial stability you desire. You will be able to debit your account and charge your purchases instead of using your card. This will enable you to take full control of your finances.

Debit cards charge less than credit card fees. There is no ATM fee and you don’t have to worry if there are high-interest purchases. Some banks will even let you enter your PIN to save money on credit card processing.

The downside to using a debit card to build credit

One of the major benefits of a debit card is that you can use it to make payments without carrying cash around. This makes it simple to pay your purchases even if there isn't enough cash. A benefit is that you won't be overwhelmed by large bills at the beginning of each billing cycle. Debit cards are a good way of building credit.

In that you don't have to report the money you spend, a debit card is very different from a card. This means that your credit score won't be affected by the debit card. This means that you can use a debit card to build your credit history and get the best interest rates.

Use a debit card to increase your credit score

People who don't currently have a credit card can use debit cards to build credit. These cards allow you to spend only what you can afford to pay back, whereas a credit card allows you to spend more than you can afford. This is not good for your credit score because the interest can add up over time.

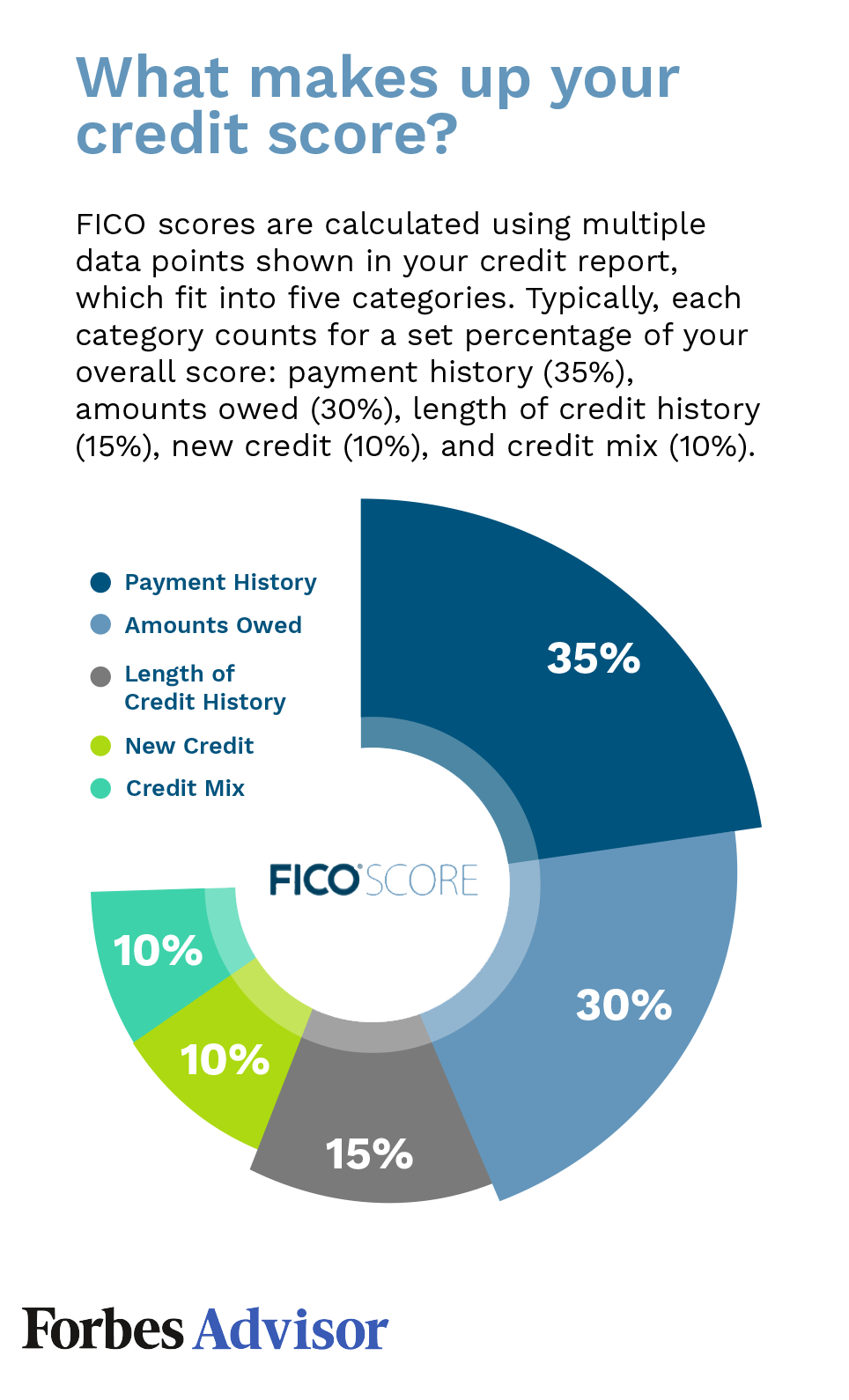

When you use a credit or debit card to purchase goods, the payments are sent to Experian TransUnion and Equifax. These bureaus look at your credit report to determine how creditworthy you are. Many banks offer FICO scores at no cost to customers during every billing cycle. The transactions you make with a debit card to build credit do not show up on your credit report.

While a debit credit card may help build your credit, it will not improve your score. A credit card shows a lender that your financial responsibility is being met, while a debit card demonstrates that you have the ability to pay off debts. If you use a credit card to build your credit score, the bank might close your account.