Identity theft can be prevented by a credit bureau fraud alert. An alert will prevent you from applying for new credit accounts until you have been verified by the company that you are who you claim to be. This verification is typically done over the phone, and you may be required to mention the date the alert was issued. However, there are some benefits to the alert.

Alert for active duty

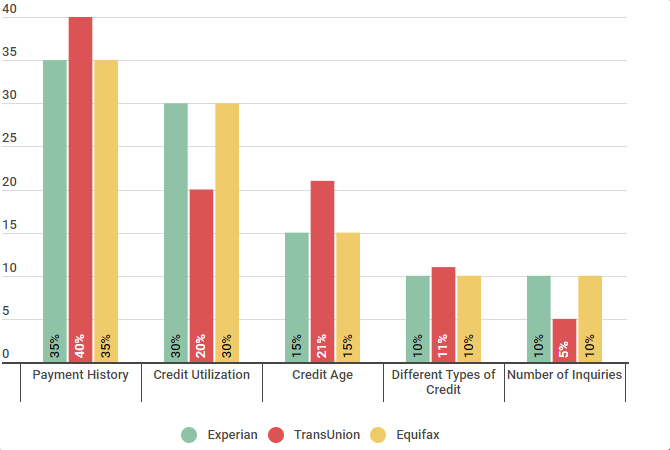

Service members can receive a free active duty credit bureau fraud alarm to help protect themselves against identity theft and fraud. This alert prevents your name appearing on pre-approved credit cards offers for one year. It can also be renewed for as long as you are deployed. This service is available from TransUnion, Equifax, and Experian. You can call or write to place a fraudulent alert. You can request an extended alert to make your alert last for longer. This will prevent the name from appearing on pre-screened offers and keep it there for two years.

Once you have requested an alert from the credit bureaus, you must inform them. To be eligible for an active duty alert, you will need to provide proof that you are real. This can include your address, name, and Social Security Number. Also, you should update your contact information prior to the alert expires. You will not be removed from pre-screen marketing lists for up to two years if you fail to do so.

Alert to initial fraud

An initial fraud alarm is a warning placed on your credit reports that will prevent identity thieves posing as you from opening new accounts. This alert stays on your credit file for 90 days, and some extend to a full year. If you suspect identity theft or have lost or stolen money, or if someone has phished you, this alert may be requested. The alert will entitle you to a free copy of your credit report from each of the four major consumer reporting agencies.

This alert is a sign that lenders are monitoring your credit application and will need to verify you identity. These alerts can cause delays in loan processing. You may want to consider using credit monitoring instead.

Dispute a fraud alert

You can dispute any credit bureau fraud alerts that you have received. The agency that sent the alert can be contacted to resolve the matter. The agency will then remove the incorrect information and send a notice to creditor companies who received the alert. Make sure to include your name and telephone number with the dispute.

A fraud alert is a notice to creditors that someone has attempted to use your identity for fraudulent purchases. This does not preclude creditors from obtaining your credit file, or issuing credit cards. It is important for you to know that a fraud alert only lasts for a short time.

Removing a Fraud Alert

It's very easy to remove a fraud alert from your credit bureau. You can complete the process online, over the phone, or by mail. The alert should be removed within days after you've completed the process. If you do NOT wish to remove the alert you can opt to let it expire. A fraud alert will automatically expire within one year of the initial alert or seven years for extended alerts.

Contact the credit bureaus directly if you want to remove your alert faster. For fraud alerts to be removed earlier, agencies may require that you provide proof of identity.