If you have bad credit, you can still get a credit card. Many credit card companies offer credit cards for those with bad credit. Before applying for a card, it is important to understand which cards are accepted by people with poor credit. You should also know the benefits of each card, in addition to knowing their acceptance rates. A card that rewards cash back can be applied for by someone with bad credit.

Unsecured Credit Cards

It is not easy to get unsecured credit cards with bad credit. However, it is possible to still find one that suits your needs. These cards are great for small purchases. In many cases, you can pay the full balance each month. This helps establish a stable payment history. Experian Boost is a free credit card program that will show your regular monthly payments on your credit score.

It is important to look at the fees when searching for an unsecured card for people with poor credit. Many unsecured credit card have high APRs and very low credit limits. They often have minimal rewards or fees. However, if you're willing to accept the restrictions that come with the card, you'll find these cards a great option. You can even earn cashback at some merchants.

Credit cards for balance transfer

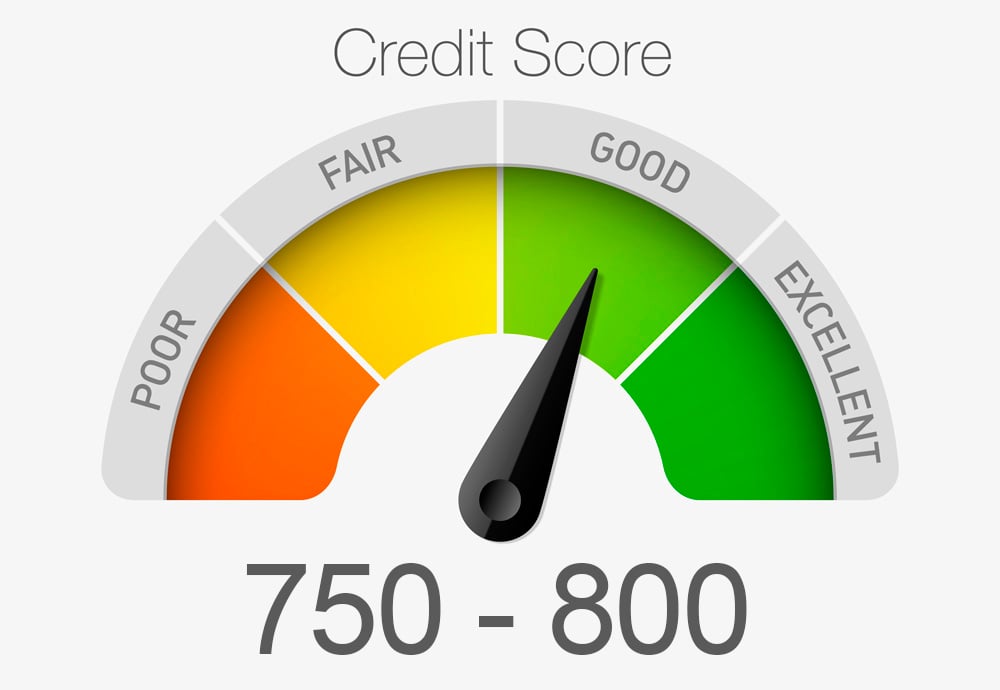

There are some good credit cards for people with bad credit and they can be a great way to improve your credit score. For balance transfers to be possible, you'll need to have a good enough credit score. An excellent credit score is 670 or more. To improve your credit score, a secured loan card with balance transfer and regular payments can be chosen. Your credit score will improve and you can be approved for a higher-limit card.

Bad credit balance transfer credit cards can be very difficult to obtain. You can improve your credit score to increase your chances of approval if you are in need. First, consider checking your debt-to-income ratio (DTI). This is an important metric and can have a significant impact on your approval. A good DTI is lower than 36%. A good DTI can help you get a balance transfer, even though each lender may have different requirements.

Credit cards with cash back

A variety of cash back rewards credit cards are available to you if you are searching for one. Most cashback rewards credit cards don’t have an annual charge. However, some do. These cards tend to have higher cash back rates and can more than make up for the annual fee. They often include sign-up bonuses that are easy to collect.

Secured credit cards are another option for those with poor credit. A security deposit can be required for this type card. This can be between $200 and $5,000. The issuer will return the security deposit when the account is closed. They don't have to risk losing it. Although these cards are easy to obtain, approval is not guaranteed. Before you commit to one, make sure to review your credit history. Application for a secured loan can be denied if there are serious credit issues or bankruptcy.

Bad credit cards: Annual fee

A fee for an annual service may seem excessive if your credit score is not good. Bad credit cards often have an annual fee. This fee can quickly add up. To offset higher card costs, some issuers have introduced new fees. You might consider a secured credit card if you want a card with an annual free fee. These cards are much easier to apply for but can have a higher yearly fee.

Unsecured credit cards do not offer rewards, so you can avoid paying an annual fee. Instead, they may have higher APRs or interest rates. The goal is to get as low a rate as possible. You will need to only use the card for purchases you are able to pay off on time.