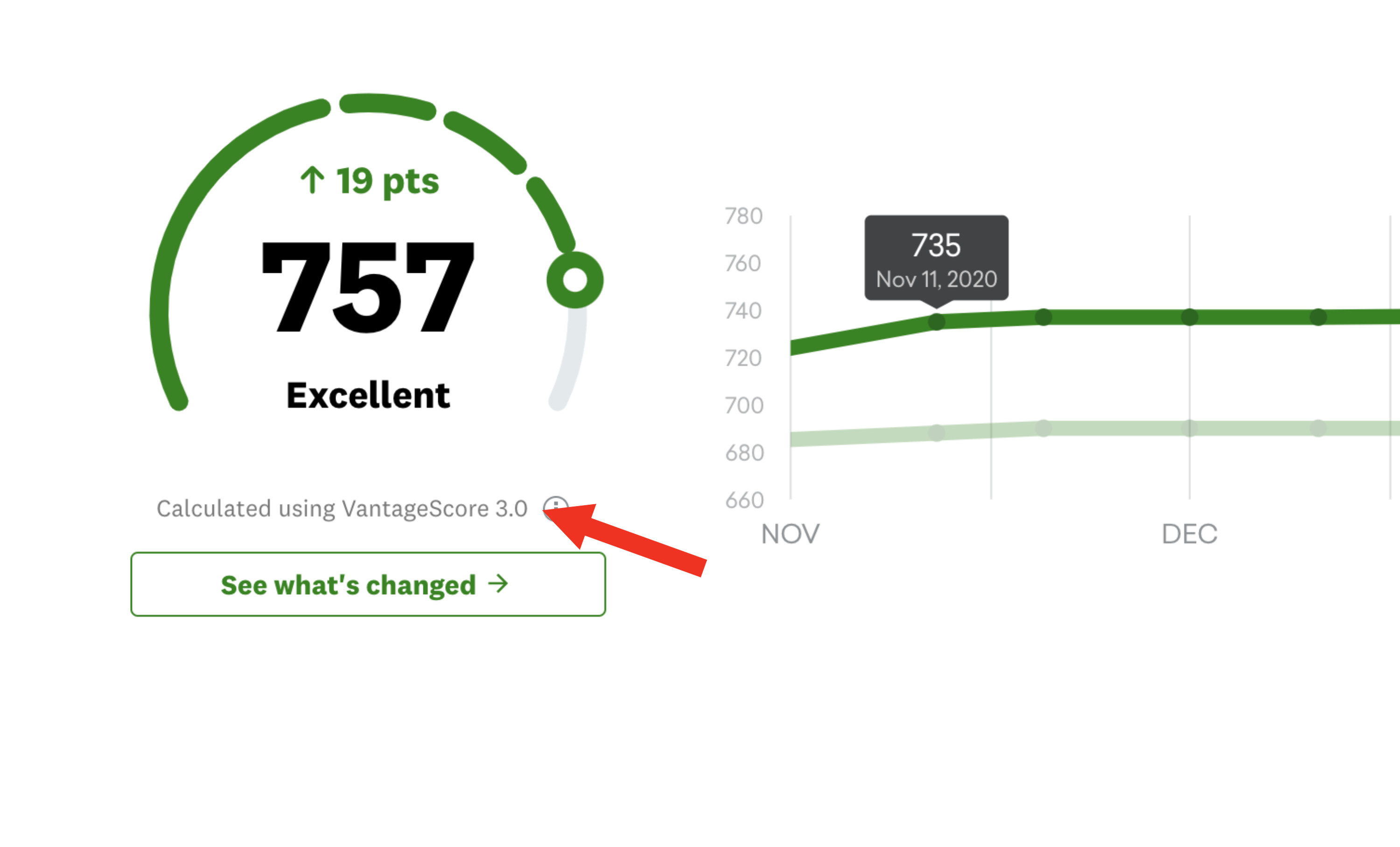

Your credit rating is a measure of your ability to repay debts. It implicitly predicts the likelihood of a debtor defaulting on payments. The number of years that a debtor is in debt is important but there are other factors which can affect a credit rating. These include payment history and length of credit history as well as conflicts of interest.

Payment history

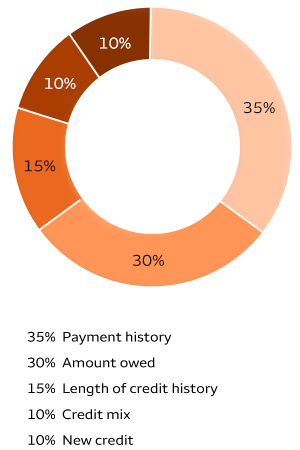

One of the most important factors of your credit score is your payment history. It is 35% responsible for your credit score. It informs lenders about your likelihood of paying your debts on time. While late payments won't affect your credit score, it can harm it. It is important to learn how your payment history affects credit scores and how you might improve them.

There is an easy solution to improving your credit score. Just make sure you pay all of your bills on time. This information is used for lending decisions by lenders and credit card providers. Your payment history can be one of the most important aspects of your credit score.

Credit history length

Credit scores are affected by your credit history. It accounts for 15% of your score and other factors also factor in, but the longer your credit history, the higher your score will likely be. Lenders want long-term customers who have a track record of timely payments.

Your credit report contains information about the length of credit history. It is used for determining your reliability. It is possible to improve your score by having an account for at minimum three years. It helps to establish your credit history. Creditors may be more inclined than others to grant you a loan if the account has been in good standing.

Credit mix

You can show lenders that it is possible to manage your debt responsibly by opening multiple credit accounts. Your credit mix is responsible for approximately 10% of your credit score. It is possible for your credit mix to fluctuate from one moment to the next. These fluctuations don't have a lasting effect upon your credit score.

Good credit mixes include both revolving as well as installment credit. Revolving credit is best if you only make one monthly payment. Installment credit is best if you only charge what you can repay each month. This will avoid interest. A personal loan is a good option if you have high credit limits and can't afford installment credit. It will demonstrate your ability to manage credit differently.

Conflicts between interests

There are a number of issues surrounding conflicts of interest in the credit rating industry. There are many issues surrounding conflicts of interest in the credit rating industry. This makes them subject to conflicts of interest, and if they are involved in the creation of a credit rating, the agencies may have an a conflict of interest in the final rating. Congress has also been investigating the matter. There are steps companies can take in order to avoid conflicts.

First, review the SEC regulations. There are a variety of regulations that the SEC has in place about conflicts of interest for rating agencies. Its guidelines apply to both issuer-paid and rating agency-owned companies. These regulations seek to prevent these conflicts from affecting the quality of rating assessments.

Fees charged by agencies

Several rating agencies charge issuers for their services. These fees can vary depending on what type of security is being offered and how large the bond. An issuer should communicate with the rating agency in advance about how many ratings they need. Before signing the rating documents it is important that you understand the fee structure. Credit rating companies must sign a contract and should not be tempted by an increase in the fee.

The reliability of a credit rating agency is crucial to the ability to provide services to borrowers. Low credit ratings can cause financial problems for borrowers. Credit rating agencies must be independent and credible. A good agency will provide accurate and objective ratings for investors and companies.