A credit card can be obtained even if your credit score is poor. Bad credit credit cards are offered by some credit card companies. Before applying for a card, it is important to understand which cards are accepted by people with poor credit. Apart from understanding the acceptance rate, it is also important to know which cards offer benefits. If you have poor credit, you may be eligible for a card with cash back rewards.

Secured credit cards

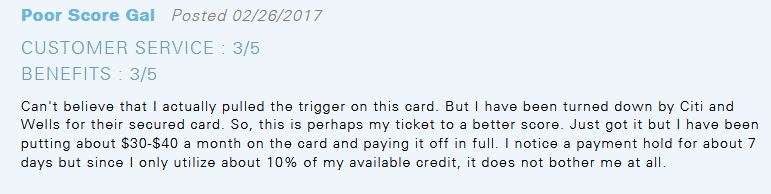

While secured credit cards are not always easy to obtain for those with poor credit, they can still be found. These cards are perfect for small purchases. You can often pay the balance off in full each month. This will help you establish a steady payment history. Experian Boost is a program that credit card companies offer for free. This will display your monthly credit payments on your credit report.

Consider the fees when looking for an unsecured credit line for people with bad credit. Many unsecured credit cards charge high APRs and have low credit limits. You also get very few rewards and fees. These cards are great if you can accept the limitations. You can even earn cash back at select merchants.

Balance transfer credit cards

There are some good credit cards for people with bad credit and they can be a great way to improve your credit score. You will need to have a sufficient credit score in order to be eligible for a balance-transfer. A credit score of 670 or higher is considered excellent. If you want to improve your credit score, you may be able to apply for a secured creditcard that allows you balance transfer and on-time payments. Once your credit score improves, you can qualify for a higher-limit credit card.

Bad credit balance transfer credit cards can be very difficult to obtain. If you need one, there are a few things you can do to improve your credit score and improve your chances of approval. First, consider checking your debt-to-income ratio (DTI). This is an important metric and can have a significant impact on your approval. A good DTI should be lower than 36%. Although each lender will have their own requirements, a good DTI could help you to receive a balance-transfer.

Cash back rewards credit cards

You have a wide range of choices when it comes to cash back credit cards. Most cash back rewards credit cards don't require an annual fee. Some cards require an annual fee. These cards tend to have higher cash back rates and can more than make up for the annual fee. Sign-up bonuses are often included with these cards, which can be easy to collect.

A secured credit card is another option for people with poor credit. This type of card requires a security deposit, which can range from $200 to $5,000. The security deposit will be returned after the account is closed. The issuer won't lose it. Although these cards are easy to obtain, approval is not guaranteed. Before you commit to one, make sure to review your credit history. Bankruptcies and serious credit problems can lead to the denial of a secured card application.

Annual fee for Bad Credit Credit Cards

An annual fee can seem unnecessary if you have poor credit. Credit cards for bad credit often come with an annual fee, and this fee can add up over time. Some issuers may add new fees to offset the higher cost of these cards. If you're looking for a card with no annual fee, you may want to consider a secured card instead. These cards are much easier to apply for but can have a higher yearly fee.

Another reason to avoid paying an annual fee is because unsecured credit cards don't offer rewards. These cards may be charged higher interest rates or have penalty APRs. The goal is to get as low a rate as possible. This means you must only use the card to purchase items that you can pay back on-time.