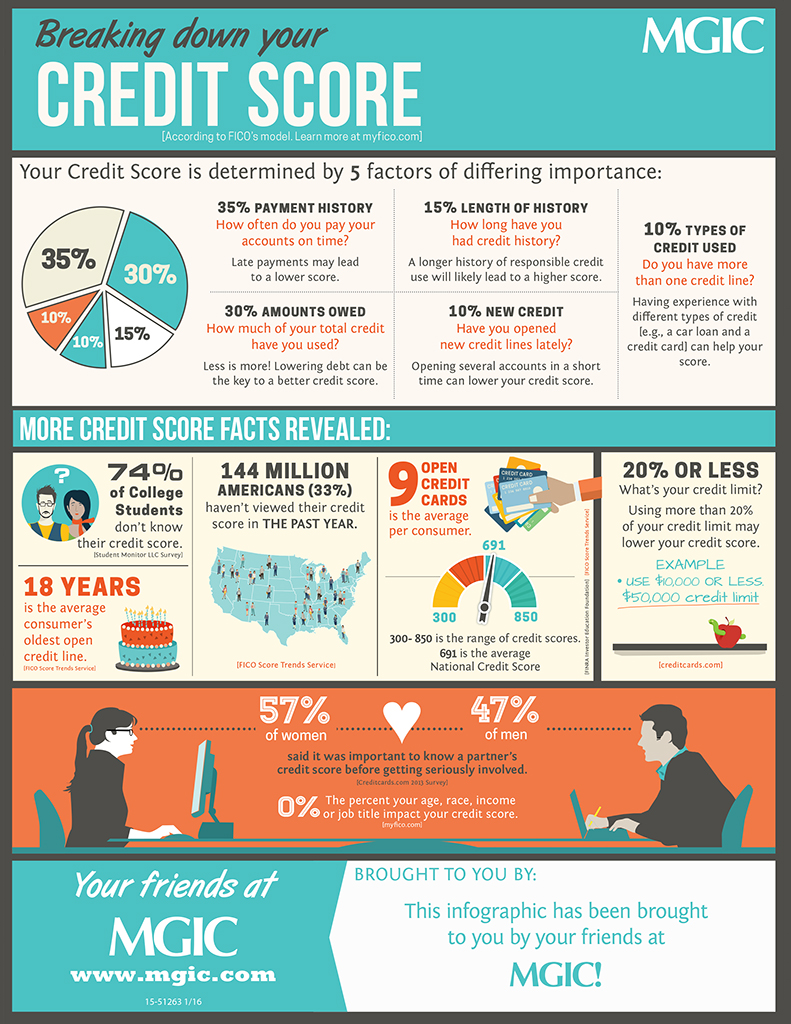

Credit score can be improved by managing your credit cards well and paying your monthly balances in full. It is important not to pay interest on any balances. Also, you should always pay more than the minimum. A lower credit utilization percentage also helps your credit score. The CFPB recommends that credit utilization not exceed 30% of total credit. That means that if you have a $2,000 credit limit, you should keep your balances below $600. Multiple credit cards can increase your credit limit.

Multiple credit card accounts can improve your credit score

Having multiple credit cards can be a good thing for your credit score. It is important to use each card responsibly and pay the entire balance each month. This will help you maintain your credit score and prevent interest charges. This will reduce your credit utilization ratio. According to the CFPB your credit balance should not exceed 30% of your credit limit. That means keeping your balances below $600 for a $2,000 credit limit.

Multiple credit cards are good for your credit score. Because lenders like to see different credit accounts, it can help you improve your credit score. This also demonstrates that you know how to manage your borrowing. Some credit cards also offer rewards programs that allow you to earn cash back, or even travel benefits. You can reduce your debt-to credit ratio, or CUR, by having multiple credit card accounts.

Manage them well

Many lenders want to see that there are many credit cards available and that you manage your debt well. It shows that your knowledge of the terms and condition of multiple credit cards is an indicator that you can manage borrowing. You can also take advantage of reward programs and other perks by using multiple cards. Your debt to credit ratio, also known by your credit utilization rate, can be reduced by having more than one card.

It is not as hard to manage more than 1 credit card. Keep track of your balances, and make sure to keep up with your payments. This will make sure that you don't accumulate credit card debt, which could negatively impact your credit score. You should also be aware of the payment due dates on each card, as missing a payment can lead to a high interest rate and missed fees. It is best to make all your monthly payments, not just the minimum.

Keeping spending in check

By controlling your spending, you can improve your credit score when you have multiple cards. It is important to pay your balance each month in full. Don't let it grow. This will help to keep interest rates low. Your credit utilization should not exceed 30% of your total credit. This means that if your credit card has a limit of $2,000, you should keep the balance below $600.

Lenders love to see a variety of credit accounts. Having multiple cards also shows that you are able to manage your borrowing. Some credit cards have unique rewards programs like cashback or travel benefits. Credit cards can also reduce your debt-to-credit ratio, also known as your credit utilization rates.

Repaying all outstanding balances each month

You can improve your credit score by paying off multiple credit card balances each month. You can lower your overall utilization ratio (also called your credit utilization rate), which is the second largest factor that will affect your credit score. By not having a balance in any given month, you can avoid interest fees.

It is actually beneficial to pay the monthly balance on all credit cards. By doing so, you can avoid late fees and interest as well improving your credit score. It will also help you keep your total balances low across all of your accounts. Lowering your balances will improve your credit score because it will be easier for you to qualify for better terms.

Multiple accounts may be opened at the same bank

It may surprise you, but multiple bank accounts won't affect your credit score. This is because credit accounts are what determine your score, and not bank account balances. Your score will not be affected by multiple bank accounts, unless you have delinquent credit cards accounts. But, having multiple bank accounts opened can impact your score. This is especially true if you have hard inquiries. This is because it makes you look like a risky customer.

Although banks and credit unions permit multiple checking accounts to be opened, the minimum balance requirements vary from one institution to another. Some institutions require that you maintain an account with a minimum balance, while others require that you have a minimum of $25 to avoid a monthly charge. Avoid these monthly fees, particularly if income is low.