You're not the only person looking for ways of building credit. Your credit score is critical for many things. But it can be overwhelming to know where and how to start. There are several methods that will help you quickly build credit. These methods include making on-time payments, applying for several credit cards, and taking out a loan to start building credit.

Making on-time payments

Your payment history is a key factor in determining credit score. This is a 35 percent factor in determining your credit score. Make sure you make regular payments. Automatic payments can be set up to pay all your bills. These debit your bank account automatically before the due date. So you don’t have to think about how much extra money you can set aside to pay for the payment.

A personal loan is another way to build your credit. This type of loan is not easy to get, but it can be very beneficial in building credit history. Be sure to only borrow the amount you can afford to repay. You can ruin your credit score by missing or late payments

A secured credit card

Secured credit cards are a great way to improve your credit score. This type of card requires that you provide a cash deposit as collateral. In return, the card is allowed to be used for purchases. The issuer can take your deposit if you are late paying.

When you start using a secured credit card, you will soon begin to see your credit score rise. This could actually happen very quickly if the payments are made on time and your balance is low. If your credit history is solid enough, you might be eligible for an unsecured card with lower fees or better rewards.

Multiple credit cards

Multiple credit cards are a great strategy for building credit. The majority of credit card applications follow a similar process and require information such as your date and Social Security numbers. Next, you'll have to pass several stages that include a credit assessment. Here are some tips to keep in mind while applying for new credit cards. Be prepared to give as much information and documentation as you can.

Multiple credit cards are a great way to increase your credit score. It may lower your score if you make too many inquiries and have too many high balances on your cards. It is possible to accumulate too much debt, which could lead to a higher utilization ratio.

A loan is taken out to help build credit

Many credit unions and banks offer loans for people trying to build credit. Remember to report these loans to the credit bureaus. This means you shouldn't borrow more than what you can afford. It is also important that you make your monthly payments on time if you are trying to build your credit rating by taking out personal loans. Failure to make payments on time can lead to a decline in credit score.

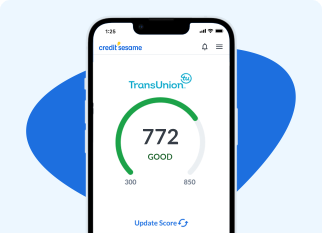

Good credit scores can help you get credit at the best rates and make it easier to obtain new credit. It can be difficult to build your credit score, but it is possible. It takes time to build credit. To keep your score high, it is important to be on top of everything and make timely payments.