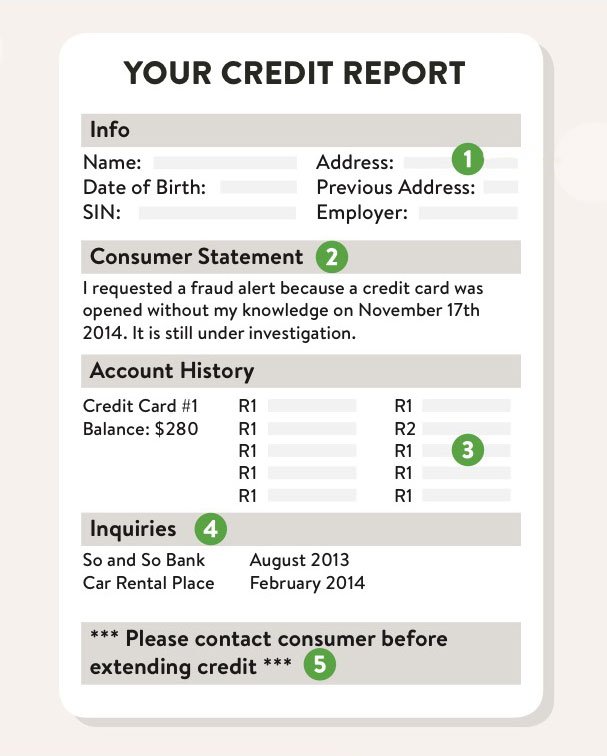

A good credit score and low income won't automatically make you ineligible for a loan. Potential lenders will be more interested in your credit history than your income as it is a sign of how well your debt management is managed. To improve your financial services access, you need to be able to identify the parts of your credit report.

Bad credit with low income

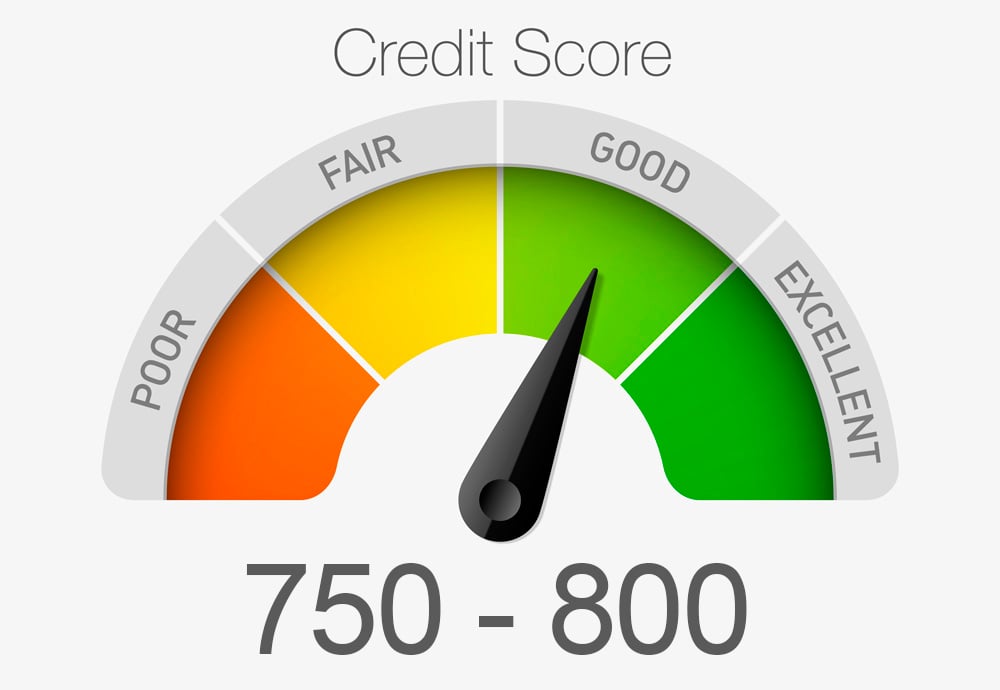

Bad credit is a major problem for many low-income families. This can make it difficult to qualify for low-income housing. However, it is important to understand that even those with poor credit can benefit from better financial management and an improved credit score. These tips will help you stay motivated: Understanding the impact on your credit score can be very important.

Applying for pre-approval for a mortgage is one of the first steps to buying a house with poor credit. This will give you an indication of your income and credit scores, so you can determine if you're qualified for a loan. Once you've received the pre-approval, you can focus on improving your score.

Bad credit with high income

It can be difficult to obtain a loan if you have a low income or a poor credit rating. However, this correlation is often true. Credit scores tend to be higher for high-earners than for those who earn less. In fact, the percentage of consumers with excellent credit scores increases as a function of income. High income does not automatically indicate bad credit. There is a variety of ways to improve your credit score.

Fortunately, a high income and high salary can often overcome a poor credit score. For landlords to be impressed, you need to earn at minimum 40 times your monthly rental income. A $300,000 annual salary can be offset with an annual income of $48,000.

Low credit limit with high credit utilization

A low credit limit combined with high credit utilization is not good. If you are a good credit holder, you should still be able to pay your monthly bill. The best credit utilization ratio is below 10%.

By calling the card issuer, you may be able increase your credit limit. If your credit score has dropped, the lender might reduce your limit. Alternativly, you might consider applying to a new no fee credit card.

People with excellent credit can get loans

Although a low income does not necessarily mean that you will not be eligible for loans, there are some things to keep in mind. The biggest thing is that you need to prove that you have a regular source of income. Most lenders want to see that you make at least $800 or $1,000 each month. It doesn't matter if you are employed full-time. However, you need to have a steady source of income that will enable you to make the monthly payment. Those sources of income could include Social Security or disability benefits.

The repayment term will be the next factor that determines the amount of your monthly installment. The shorter the repayment term, the lower your overall borrowing costs, but the larger your monthly payment. Choose a lender with a repayment period that is within your budget. You can apply online for many lenders, and the process doesn't hurt your credit score.

People with high credit scores can get loans

Lenders will consider your income sources in order to determine if the borrower is a suitable candidate. You may also be eligible for Social Security benefits, retirement funds, side gigs, public assistance such as alimony, child care, and long-term disabilities. Your income may not be sufficient to qualify for a loan.

Bad credit can keep you from getting a loan. It is important to raise your credit score before applying for a loan. It is possible to reduce your credit card debt. This will give you more cash and reduce the interest charges on your debts. Credit cards can be used to pay your bills and help lower your debt-to-income ratio.