There are five major factors that affect your credit score. It is possible to get a high credit score by disputing false information and keeping your credit clean. It can take several years to correct credit history that has many public records and delinquencies.

Score of 850 Credit

Although it may seem impossible for an individual to have a credit score of 850, it is possible. Experian found that only 1 percent of American adults have a score above 850. You don't have to be a pro at maintaining a high score. There are simple steps you could take to increase your score.

Requests for hard copies

You may have noticed that the number of applications you make each year affects your credit score. These inquiries may reflect your credit shopping behavior and be relevant to potential lenders when assessing your creditworthiness. Multiple inquiries count generally as one. However, the time period varies depending on credit scoring models. This period serves to allow you research and compare loans, without adversely impacting your credit score.

Age

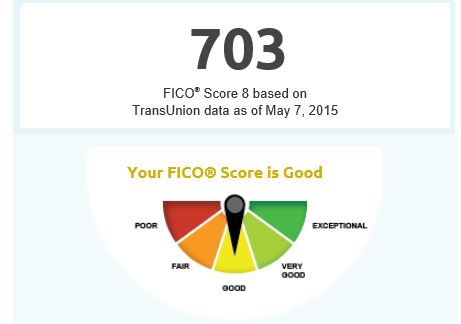

Good credit history is an excellent way to increase your credit score. While you can't get to 850 overnight, there are several things you can do to raise your credit score over time. First, you need to take the time and understand your credit history. Your credit score will be affected by your age. Average credit scores for people in their 20s are around 660. The 733 credit score is the best for this age group.

Income

The average credit card balance of the 850 credit scoring club is higher that the average population with a balance of $32,872 as opposed to $17 064. It's important to note that members of this club are mostly older. The highest percentages of credit score holders with 850+ credit scores are the baby boomers and the silent generations, while Generation Z and millennials make up only 25% of the 850+ FICO(r club members.

Paying bills on time

Payment history is a key factor in getting 850 credit scores. Your credit score will increase the more you pay your bills on time. It is crucial to pay all your bills on time. Also, make sure that you do not have any outstanding balances. Having a clean payment history is vital for getting approved for a loan or mortgage.

Having a good financial habit

Having a good financial habit is one of the most important steps you can take to improve your credit score. A high score reflects your ability to manage your credit and your debt. High-scoring people have a long credit history, excellent payment records, and a balance between their available credit and any unpaid balances. These people also use a smaller percentage of their credit limit. These borrowers are considered to be less risky than those with higher credit scores.