Morales built his credit by using a credit card. He even asked a relative to co-sign his account. This helped to increase his credit and help him avoid payday loans. It is crucial to pay all your bills on time. Bad credit could result.

Secured credit cards

Getting a secured credit card is an effective way to improve your credit score. A secured card can typically help you raise your credit score in six months. Some issuers will offer you the opportunity to move to an unsecure card if you show responsible behavior.

The security deposit is usually as little as $200. This amount is your credit limit. Some secured credit cards also give you the opportunity to increase this limit. As low credit utilization is a key factor in a good credit score, this flexibility can prove invaluable as you rebuild your credit.

Retail credit cards

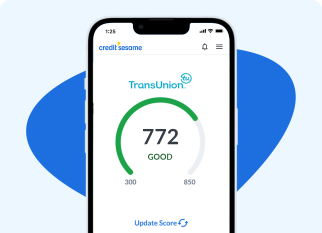

Building credit can be difficult, especially if there is no work history. In order to get loans, credit cards, and apartments, you need to be able to show lenders that you have a track record of repayment. There are many things you could do to improve credit scores. The first step is to check your credit report for free to see how you stack up against others. This will enable you to identify the factors that impact your score and what you can do to improve it.

To improve your credit, it is important that you make sure you pay all your bills on schedule. It may sound counterintuitive but this can make all the difference in your credit score. Missing payments add derogatory marks to your credit history. Although credit cards can seem appealing to improve your score and help you save money, it is best not to spend more than 30% on your credit limit.

Being punctual in paying your bills

It is important to pay your bills on time when building credit. Your payment history makes up over 35% of credit score. Late fees and a negative credit score can be imposed if you fail to pay your bills on time. Credit reports will contain information about your credit card, loans, and utilities. It may also include information about the credit bureaus' payment history, such as that of your cell company. No matter what product or service you use, it is crucial to pay your bills promptly.

No matter whether you have a job, or not, it is important that you pay your bills promptly to maintain your credit rating. You can also choose to establish online accounts, which will help you keep track of your spending and pay your bills on time. This can help you increase your credit score.

Payday loans should be avoided

Borrowing more than you actually need is one of many reasons why people end up in debt. It is important to know how much money you can afford each month, and only take out the amount you truly need. If you can, get a co-signer who has a good credit history. The co-signer will help you get a better loan.

Payday loan lenders require you to have a bank account in order to be approved. Although most payday loan lenders make their payments by direct deposit, there are some who may try to take the money out of your checking account to recover what they owe. Payday loan lenders may make unexpected withdrawals that can lead to overdraft fees, which can negatively affect your credit score.